Unlock the Power of Debt Buying and Selling with Triton Financial Solutions

As a leading debt brokerage company, Triton Financial Solutions is revolutionizing the debt industry by connecting creditors, debt buyers, and collection agencies. Our expertise lies in debt acquisitions, sales, and intermediation, providing unparalleled liquidity solutions for creditors and meticulously curated debt portfolios for discerning buyers. Our main objective: establish long-lasting business relationships that provide extraordinary value to our debt buyers, debt sellers, and creditors alike.

Maximizing Returns: Discover Our Strategic Approach in Debt Acquisitions

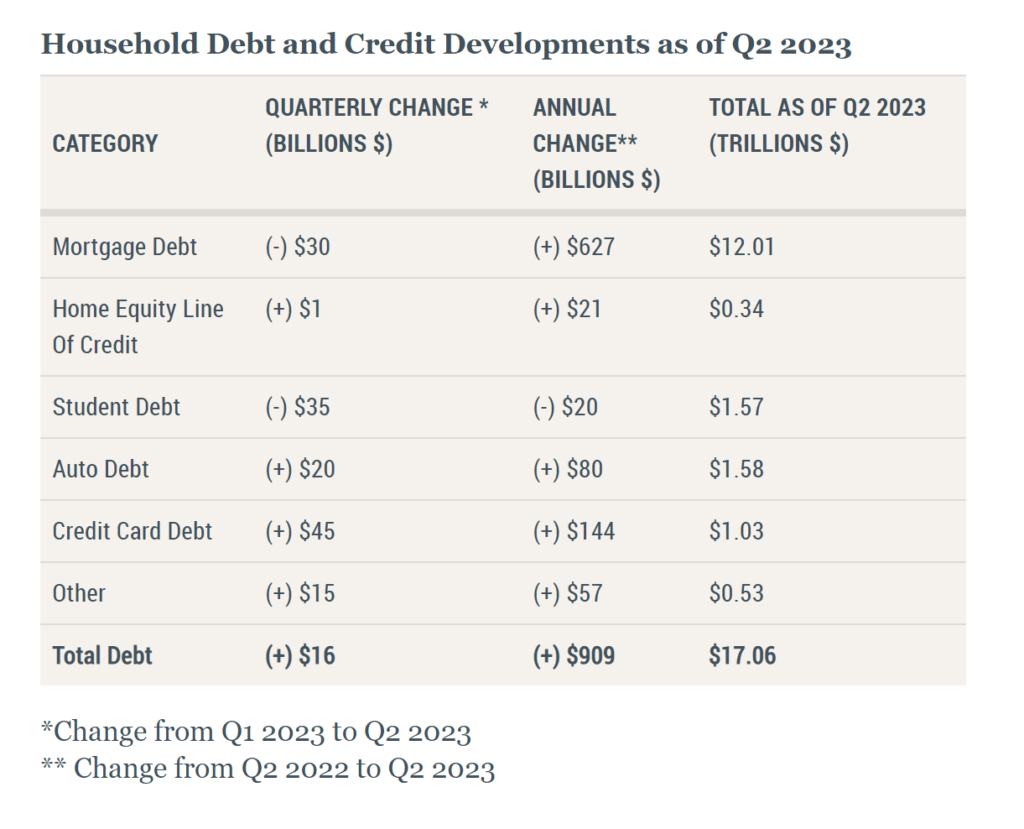

With the US credit card debt hitting a record $1 trillion , the debt market is ripe for investment. Triton Financial Solutions is at the forefront of this transformation, serving as a pivotal link between debt sellers, debt buyers, and collection agencies. Our transparent, efficient, and tailored approach ensures a seamless transition of distressed assets into capable hands, allowing creditors to realign their focus on core operations. US Credit Card Debt Hits Record $1T

EMPOWERING CREDITORS WITH UNPARALLELED LIQUIDITY SOLUTIONS

In today’s rapidly evolving financial landscape, maintaining healthy cash flow is paramount for creditors. Triton Financial Solutions offers vital liquidity solutions by purchasing bad debt from creditors, providing a strategic partnership that benefits both parties. Our debt sale process is designed to be efficient, transparent, and tailored to the unique needs of our clients. Learn more about selling bad debt and how it can benefit your business.

CURATING PROFITABLE DEBT PORTFOLIOS FOR BUYERS

Navigating the complexities of the debt market can be daunting for debt buyers. Triton Financial Solutions simplifies this process by providing a diverse range of meticulously curated debt portfolios, including fintech, lines of credit, installment loans, payday loans, credit cards, utility debt, auto loans, and medical debt. Our expertise lies in identifying and assembling high-quality, lucrative portfolios tailored to the unique investment and collection strategies of our clients. Explore our comprehensive inventory to discover how to buy debt and optimize your investment strategy.

Our Portfolio List Typically Includes:

- FINTECH

- LINES OF CREDIT

- INSTALLMENT LOANS

- PAYDAY LOANS

- CREDIT CARDS

- UTILITY DEBT

- AUTO LOANS

- MEDICAL DEBT

- REAL ESTATE – MORTGAGE NOTES

Creating Win-Win Solutions (Benefits for Debt Buyers, Debt Sellers, and Creditors)

At Triton Financial Solutions, we believe in fostering mutually beneficial outcomes. Our mission is to enhance the financial well-being of creditors through seamless liquidity solutions while empowering debt buyers to invest in quality portfolios that drive their success. Learn more about debt collection and how Triton Financial Solutions can support your objectives.

Redefining the Debt Market

Join us in reshaping the landscape of the debt market. Whether you’re looking to divest distressed assets or capitalize on promising debt collections, Triton Financial Solutions is your trusted partner in navigating the intricacies of debt management. Discover how to sell debt and unlock new opportunities with Triton. Our debt broker services are designed to connect debt sellers with debt buyers, providing a seamless and efficient process for both parties.

Looking for non-performing debt portfolios? Check out our complete list of debt available to purchase by completing our debt buyer registration form

For a glimpse into our current inventory, please reach out to us to receive our inventory list, NDA, and buyer registration form via email at portfolios@debtmarket.net or call us at 561-254-6608. Together, let’s unlock new opportunities and drive success in the ever-evolving realm of debt management.